Mortgage Payment FAQs

Protect Your Credit Score | Go Paperless | Enjoy More Free Time

Set Up Automatic Loan Payments

Scheduling your mortgage payment to automatically come out of your checking account is easy! Click below to download, complete and send the authorization form to us by secure email, mail, or in person at any Middlesex Federal location; we'll take care of the rest.

AUTOMATIC LOAN PAYMENT AUTHORIZATION FORM

Schedule One-Time or Recurring Online Loan Payment

To make one-time or recurring payments online, follow the instructions below. Once you register for Online Banking, you'll also have the added benefit of viewing your tax documents online.

1. Log In or Register for Online Banking to schedule one-time or recurring loan payments.

ONLINE BANKING LOG IN

NEW USER REGISTRATION

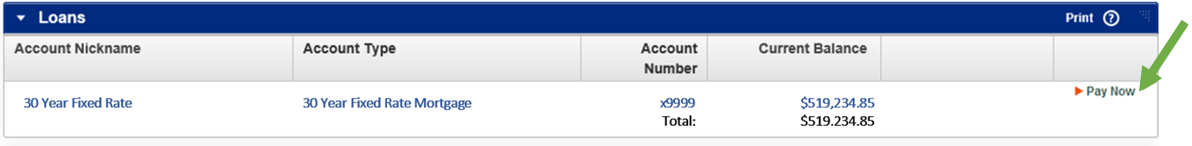

2. Click "Pay Now" located to the right of your account.

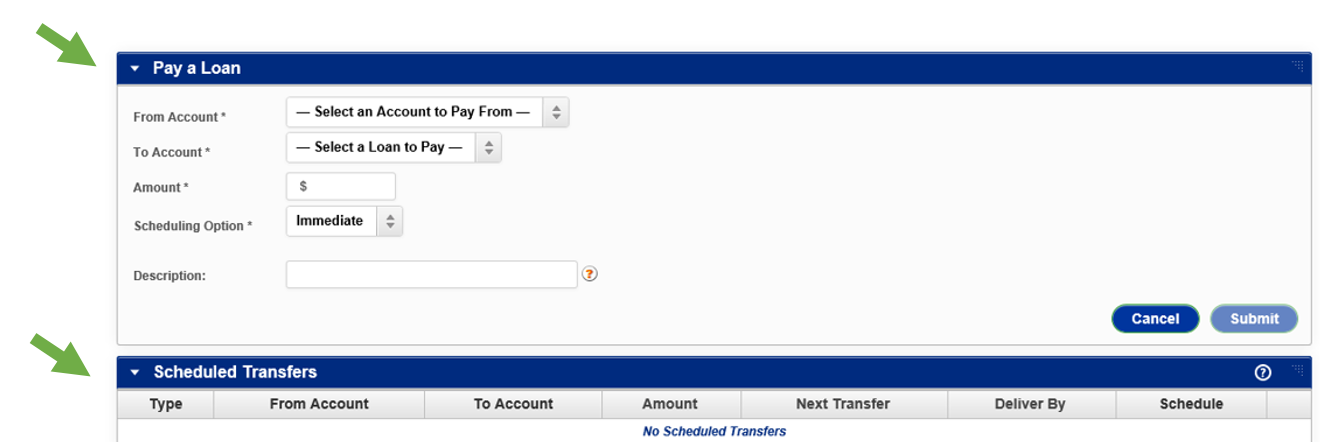

3. To schedule a loan payment using funds from your Middlesex Federal account, complete the "Pay a Loan" section for a one-time payment or the "Scheduled Transfers" section to set up recurring payments.

NOTE: To schedule an online loan payment using funds from your account at another institution will require you to create a bank-to-bank transfer link. To do this, click on the Transfer tab and select bank-to-bank transfers. You'll be asked to verify micro-deposits (amounts less than $1) that will be deposited into and removed from your external account. Once your account has been verified, it will be included with your other accounts listed in the drop-down menu.

4. Questions? Use our Online Banking Message Center to send us a secure email. Or, complete and submit the form on this page. We'll gladly answer your questions or assist you.